The SG rate was 95 on 1 July 2014 and was supposed to increase to 10 on 1 July 2018. Employers should be aware of the Selangor public holiday to better manage business expectations and staffing requirements to ensure a smooth.

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Employee Provident Fund 2 Social Security Organization 3 Inland Revenue Board Of Skachat Besplatno I Bez Registracii

If you are interested to know the calculation of the EPF contribution formula you have came to the right place.

. Should an employee choose to remain at 11 contribution rate theyll need to fill up Borang KWSP 17A Khas 2021 which will then be submitted to EPF by their respective employer. Public Holidays in Selangor for 2022. Get the right form you need right here.

Effective from April 2020 salarywage up to December. However if the employee is willing to pay contributions at 11 rate heshe should fill the Borang KWSP 17A Khas 2021. The monthly wages of Malaysians aged 60 and over and non-Malaysians of any age do not affect the employers EPF contribution rate.

In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia. Employees EPF contribution rate. Meanwhile the employee share statutory contribution rate reduction programme which ran for 27 months from April 2020 to June 2022 had impacted the pension fund by another RM10 billion Shahar.

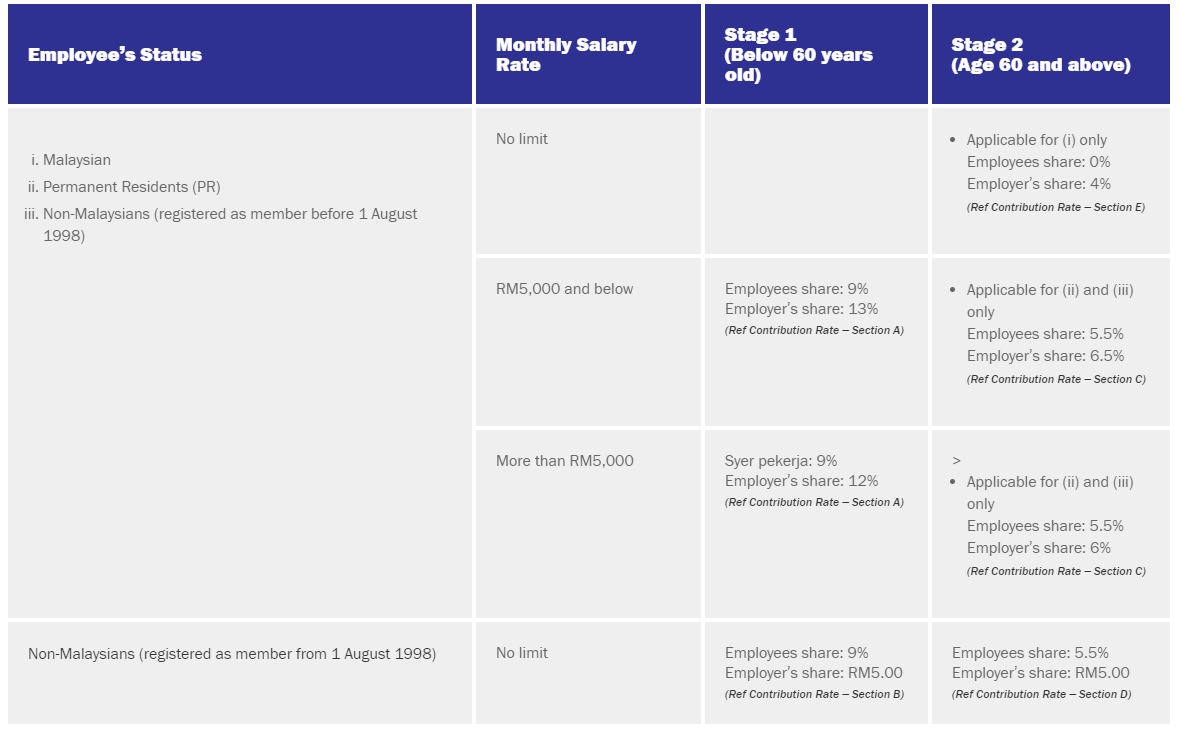

EPF Contribution Rates for Employees and Employers. KWSP EPF Contribution Rates. Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000.

After the budget-2021 the EPF contribution rate is reduced from 11 to 9 February 2021 to January 2022 for employees under 60 years of age. For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13. The employer EPF contribution rate is 12 instead 13 anywhere can i edit this section.

The amount is calculated based on the monthly wages of an employee. The contribution rate increased over time. Employers can now easily access all the forms you need when it comes to registration updates and also contribution in one central location.

EPF Employees Provident Fund KWSP SOCSO Social Security Organisation PERKESO EIS Employment Insurance System SIP. Since 2020 the default. The current contribution rate is in accordance with wagesalary received.

Employers EPF contribution rate. Despite employees being able to submit the Borang KWSP 17A Khas 2021 form as early as 01122020 employers are only allowed to upload VEKHAS2021 csv file on i-Akaun Employer starting from 14122020. The application for employees to contribute above the statutory rate will be in effect from January 2021 wages OR for wages on the month.

Wages StatementSalary Slip shall include the following. The contribution amount of employer and employee shares shall be based on the Contribution Rate Third Schedule of the EPF Act 1991. Salary more than RM5000 still calculate as 13 for EPF Employer contribution.

The employer is responsible to contribute the employees share by deducting the employees salaries and the employers share. Log in to Reply. Employers EPF contribution rate Employees EPF contribution rate Monthly salary rate RM5000 and below More than RM5000 RM5000 and below More than RM5000 Malaysian age 60 and above 4 0 Malaysian below age 60 13 12 9 Permanent resident below age 60 13 12 9 Permanent resident age 60 and above 65 6 55.

The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable public sectors as well as voluntary contributions by those in the informal sector. For employees with monthly wages exceeding RM20000 the employees contribution rate shall be 9 while the rate of contribution by the employer is 12. Contribute More Than The Statutory Rate Employee KWSP17A.

YOUR ONE-STOP EMPLOYER FACILITY. And then increase by 05 each. These dates may be modified if official changes are announced.

EPF contribution rate shown in the EPF table does not apply to foreigners registered as EPF members before August 1 1998. The standard practice for EPF contribution by employer and employee are. The Kerajaan Negeri Selangor has released the dates of 2022 public holidays happening in Selangor Malaysia.

In 1992 under the Keating Labor Government the compulsory employer contribution scheme became a part of a wider reform package addressing Australias retirement income dilemma. Employer at 12 or 13 whereas employee contributes 11 of monthly salary to the EPF.

New Statutory Contribution Rate Of 2021 9 Or 11

Epf Contribution Rates 1952 2009 Download Table

How Will The Reduced Epf Contribution Affect Malaysians Citizens Journal

20 Kwsp 7 Contribution Rate Png Kwspblogs

How To Calculate Epf Bonus If Employee S Wages Less Than 5k But Bonus Wages More Than 5k Qne Software Sdn Bhd

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

Epf Contribution Rates 1952 2009 Download Table

Sql Account Estream Hq Employee Epf Contribution Rate From 11 Reduced To 7 Effective From 1 April 2020 To 31 December 2020 Employer Epf Current Contribution Rate Not Change To

Confluence Mobile Support Wiki

Download Employee Kwsp Contribution Pics Kwspblogs

India Payroll What Is Employee Provident Fund Epf And Employee Pension Scheme Eps How It Is Calculated In Deskera People

Sage Payroll Epf Statutory Contribution Rate Setup 2013 Sage Ubs Software

Epf Change Of Contribution Table Ideal Count Solution Facebook

Sage Ubs Software Ubs Update Payroll Epf Statutory Contribution Rate Setup Effective On August 2013

Pf Contribution Rate From Salary Explained

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

- download film boboiboy the movie 2 full movie sub indo

- mewarna hari kemerdekaan 2018

- penyata bank maybank

- undefined

- kwsp employer contribution rate

- kedai rambut palsu lelaki

- borang mrsm 2019

- resepi sup iikan merah

- maybank gold rate today

- cara membuat kue lobak putih

- kad kredit cash advance

- kota samarahan map

- contoh surat tawaran kerja kontrak

- lukisan warna hitam putih

- borang e tahun 2019

- cara download boboiboy movie 2

- malaysian automotive lighting sdn bhd

- kad jemputan singapore

- kad kahwin digital malaysia

- oug parklane condo